Tidbits from FSRA’s Latest Pension eBlast

Last week, the Financial Services Regulatory Authority of Ontario (FSRA) issued their quarterly Pension eBlast and it’s chock full of interesting tidbits.

Final Guidance

FSRA released its final guidance on Actions to Avoid Deregistration of a Pension Plan under the Income Tax Act. The final version is essentially the same as the draft version that we talked about in a previous blog.

Pension Plans are Healthy

Despite the market turmoil so far in 2022, the majority of defined benefit pension plans in Ontario are in good financial shape.

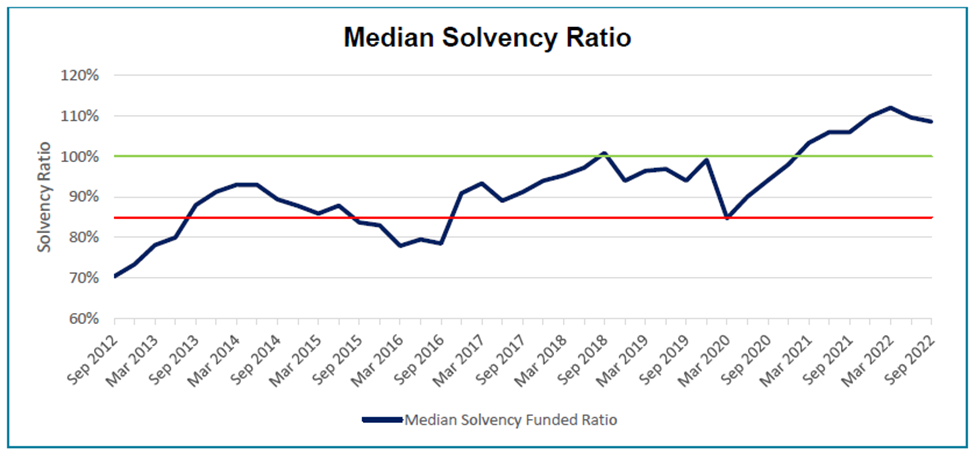

FSRA estimates that the median solvency ratio is 109% as at September 30, 2022, plus only about 3% of plans are below 85% solvency funded. This is despite estimated year-to-date returns of -16% for the average pension plan. In most cases, rising long-term interest rates have caused the plan’s liabilities to decrease at more-or-less the same rate as the plan’s assets.

The following graph, taken from FSRA’s latest report, shows the progression of the median solvency ratios over the past decade. How does your pension plan measure up?

Pension Services Portal Mandatory in 2023

FSRA’s Pension Services Portal has been in regular use by most of us for many years now, and with the pandemic causing many of us to use electronic communications as much as possible, the days of mailing in your plan amendment or valuation report to FSRA are numbered.

As of January 1, 2023, if a filing, application or request can be submitted using the portal, it must be submitted using the portal. I don’t think this should be a problem for anyone given that most of us are doing this already. FSRA is also doing a good job to regularly expand the types of submissions that are available on the portal.

Now, if only CRA’s Registered Plans Directorate would permit electronic filing of amendments and valuation reports. They’re still stuck in the dark ages of faxes and snail mail!

Are Your Filings Up to Date?

After plenty of warnings, FSRA has confirmed that they have begun the process of levying Administrative Monetary Penalties (AMPs) when a pension plan is late with its required filings or otherwise non-compliant. We’ve talked about AMPs before, and with all the second chances provided by FSRA to bring the plan back into compliance, no plan sponsor or plan administrator should be surprised when issued an AMP. FSRA has also threatened to start naming-and-shaming pension plans who are late filers, although I’m not sure this will be as effective as AMPs – having your company’s name on a website is probably nowhere near as painful as writing a cheque to the government.

In my experience, the number one reason why a plan sponsor falls behind on their FSRA regulatory filings is that the person who was previously responsible for making sure things got done no longer works for the plan sponsor. Internal governance processes need to be robust enough so that when someone leaves, their critical compliance tasks are passed along to their successor.

Just like former pension plan members need to keep their contact details updated with the pension plan administrator, so too do plan sponsors need to advise FSRA when there’s a change in the contact person responsible for the administration of the plan. We are fortunate that we attract clients that don’t want to miss deadlines and, with our proprietary work inventory and reminder system, missed deadlines are a very rare occurrence.

Pension Plan Documentation Best Practices

FSRA is reminding plan administrators that their fiduciary responsibilities include the need for good document management practices. Given the very long-term nature of pension plan promises, timelines can extend from when an employee is hired until they and their spouse eventually die, it’s therefore critical that relevant historical records are maintained basically forever.

In particular, if your pension plan text has been amended multiple times it may be prudent to consolidate and restate the pension plan text so that everything is in one document. It seems like a recipe for errors if you need to trace through multiple overlapping amendments and addendums to properly administer the pension plan. That being said, after the consolidation don’t throw out all the old documents – you never know when you’ll need to go back in time to double check something.

On the Horizon

Mark your calendars! February 16, 2023 will be FSRA’s Pension Awareness Day. Stay tuned for more information on this important initiative aimed at reaching out to the public about saving for retirement.

Comments