FSRA’s Annual Report on the Funding of Defined Benefit Pension Plans in Ontario

Every year, the Financial Services Regulatory Authority of Ontario (FSRA) produces a report on the Funding of Defined Benefit Pension Plans in Ontario. I’m not sure how many people actually read past the executive summary in the report, but I’m certainly one reader that can’t get enough of the charts and tables inside. My true math-nerd colours showing through! But please bear with me as I share some of the insights from this report.

Good News – Plans are Generally Well Funded

FSRA reports that the estimated median going-concern funded ratio as at December 31, 2020 was a relatively healthy 114% and similarly the median projected solvency ratio was 96%. Further, based upon the most recent quarterly report, the median projected solvency ratio has improved to 106% as at September 30, 2021. Defined benefit pension plans in Ontario are fairly well funded – on average.

Bad News – The Slow Decline of DB Pension Plans Continues

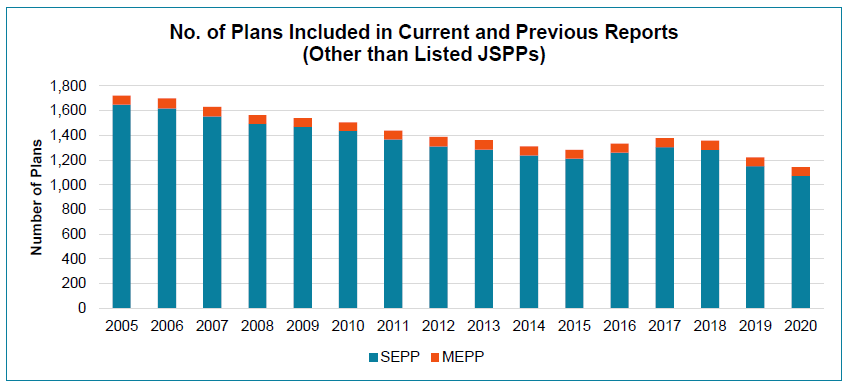

The following chart shows the number of defined benefit pension plans (excluding IPPs) registered in Ontario over the past 15 years:

It’s no surprise to anyone in the industry that the continued slow and drawn-out death of many DB pension plans has continued. If anything, the trend over the past couple of years appears to have accelerated somewhat – the leading cause of death continues to be plan wind-ups, but asset transfers (which include plans merging with each other or being absorbed by a large Jointly Sponsored Pension Plan like HOOPP, CAAT, or OPtrust) also play a significant role over the past few years.

‘Big’ News – Larger Pension Plans Invest Differently

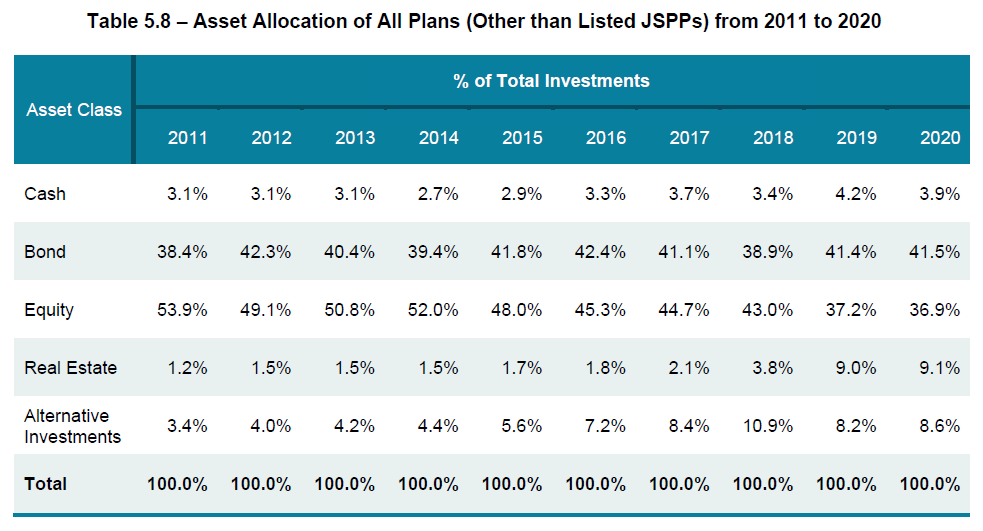

While not surprising, it’s interesting to note that DB pension plans with less than $100 million of assets currently invest less than 1% of their assets in so-called ‘alternative investments’ such as hedge funds, private equity, infrastructure, resource properties, commodities, etc. On the other hand, the large Jointly Sponsored Pension Plan including HOOPP, CAAT, OPtrust, OMERS, and Teachers invest nearly 30% of their assets in alternatives.

Based upon FSRA’s statistics in the following table, the trend for the average DB pension plan over the past decade is clearly to reduce equity investments in exchange for more investments in real estate and alternatives. The largest plans are leading the way, but the others are certainly following.

That being said, while the smaller pension plans are enjoying more exposure to some alternative assets through new pooled fund offerings, they continue to be at a disadvantage with respect to investment fees due to their poor economies of scales when compared to the largest pension funds.

In our experience, many smaller pension plans tend to be less focused on managing their suppliers and costs – taking more of a ‘this is just the way it is’ attitude. ASI regularly helps clients look at their partners to make sure they are getting an arrangement that optimizes value. Feel free to reach out if you would like to discuss the opportunity to review your pension plan governance and/or your supplier arrangements.

Not News – COVID-19 Pension Funding Relief

Finally, some of you may recall that back in September 2020 the Ontario government proudly announced temporary funding relief for defined benefit pension plan sponsors due to the pandemic in the form of a contribution deferral. My blog at the time predicted that this was “too little too late” and that few, if any, plan sponsors would take advantage of the funding relief.

Well, we now know with certainty that exactly zero employers took advantage of this offer.

Jason 1

Government 0

Late-Breaking News – FSRA Has Been Busy!

Over the past few weeks there has been a lot of activity in the Ontario pension industry with FSRA releasing a new Form 7 for reporting contribution requirements, new guidance applicable to DC plans, and new marriage breakdown forms and guidance, plus I’m aware that there is even more guidance on the horizon from FSRA that we’re likely to see shortly.

Stay tuned for my next blog where I will review these latest developments.

Comments