Ontario Offers DB Pension Funding Deferrals

On September 21st, the Ontario government published Regulation 520/20 which offers temporary funding relief for defined benefit pension plan sponsors in the form of a contribution deferral.

Eligible private sector employers will be able to defer up to six months of pension contributions from October 1, 2020 to March 31, 2021. All deferred contributions must be paid with interest and in accordance with a schedule by March 31, 2022. The stated intention is to help with the employer’s cash flow during the COVID-19 pandemic.

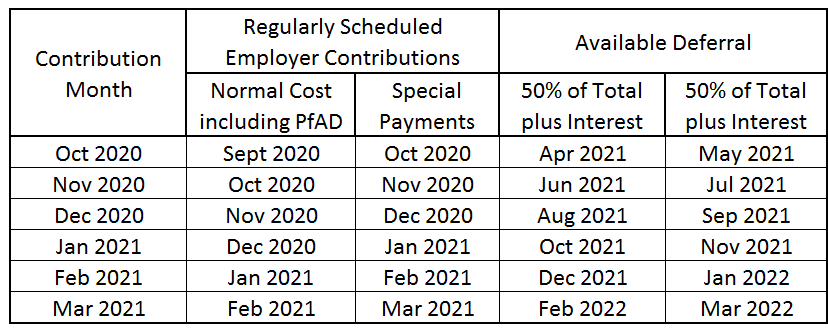

Specifically, the amended regulations permit eligible employers to defer one or more consecutive monthly payments of employer contributions with respect to normal cost (including related provision for adverse deviations – PfAD) and special payments. Employee contributions to DB pension plans are unaffected by these amended regulations. The following table provides details on the available deferral opportunity:

For example, the employer contribution that would normally be deposited in October 2020, which included normal cost and PfAD for September 2020 and special payment for October 2020 may be deferred. Half of this deferred contribution, plus interest, is due in April 2021 and the remaining half, plus interest, is due in May 2021. Effectively, the contributions over the 6-month period from October 2020 through March 2021 are able to be spread over the 12-month period from April 2021 to March 2022, with an applicable adjustment for interest.

Any employer that elects to use these deferrals will be subject to restrictions to help ensure that funds made available from the contribution deferral are used to maintain business operations. The restrictions cease to apply once all deferred contributions are made. Restrictions include:

- No dividends or return of capital permitted to shareholders

- No share buy-backs

- No bonuses whatsoever to any executives

- No increases in compensation to any executives

- No debt repayments in excess of those already scheduled prior to September 21, 2020

- No loans or advances to shareholders or executives or related parties

- No related party transactions under terms and conditions that are less favourable to the employer than market terms and conditions

- No plan amendments to increase pension benefits unless in collective agreements prior to September 21, 2020

These changes are essentially aimed at broad-based single-employer DB pension plans, as the following plans are ineligible for the deferral:

- DC pension plans

- Multi-employer pension plans

- Jointly sponsored pension plans

- Public sector pension plans

- Designed plans under the Income Tax Act

- Individual pension plans

- Any pension plan that is not current with respect to its past contribution requirements

The Financial Services Regulatory Authority of Ontario (FSRA) has updated its Pension Sector Emergency Management Response Guidance to reflect the amended regulations. The updated Guidance sets forth the process by which FSRA will administer the temporary contribution deferral framework.

While the good news is that FSRA approval is not required to take advantage of these deferrals, the reporting requirements will be fairly onerous. For an employer that takes advantage of the maximum deferral, this will include:

- Filing an election form before October 31, 2020. A report prepared by an actuary must also be included, showing details of the deferred contributions and the repayment schedule with interest. An updated estimated solvency position as at October 1, 2020 must also be calculated and disclosed.

- Preparing update reports every three months for the duration of the deferral and filing these reports within 30 days. So, the first update report will be as at January 31, 2021 and filed by March 2, 2021, and the final update report will be due as at April 30, 2022 and filed by May 30, 2022. The update reports must be prepared by an actuary and include details on payments made and interest paid during the three-month period, details on any additional deferrals, and updates to the repayment schedule. Updated estimated solvency positions at the end of each three-month period must also be calculated and disclosed. Finally, a statutory declaration by an officer of the employer, duly notarized, confirming compliance with the contribution schedule and the various restrictions outlined above regarding dividends, bonuses, salary increases, etc.

- Notifying all pension plan members, including former and retired members, of the employer’s election to defer required contributions and when the last repayment is scheduled to be completed. This information must be included on the regular annual and/or biennial pension statements.

Employers will need to carefully weigh the need and benefits of these deferrals versus the additional costs of compliance and the restrictions imposed on their business. Effectively the employer will be borrowing from their employees and it seems reasonable to me for the government to impose rules on the employer, just like a bank lender would impose various covenants in a similar situation.

It’s unclear to me how much demand there is for contribution deferrals from DB pension plan sponsors; however, we will certainly find out in the next month or so. Regardless, my feeling is that these new temporary funding relief measures are too little too late and may only be of limited value for employers in the most dire of financial situations.

ddddd

P.S. Unrelated to the above deferrals, the Ontario government also made a small temporary change giving DB pension plan sponsors up to 120 days, instead of 60 days, to make a “catch-up” contribution if an actuarial valuation report is filed on or before April 1, 2021. This change is not subject to any of the restrictions or reporting requirements outlined above.

Comments