The 30th Actuarial Report on the CPP – December 31, 2018

Just as we were heading into the holidays, Canada’s chief actuary published the 30th Actuarial Report on the Canada Pension Plan as at December 31, 2018. Three years ago, we received the report in September, but this time around the federal election delayed the presentation of the report to Parliament which is a necessary step before us regular folks get to see how things are going.

Unnoticed by many I am sure, we have a new chief actuary. Jean-Claude Menard held the role of chief actuary for as long as I can remember and with his retirement last year the torch has been passed to Assia Billig. Before you start to worry that we have lost the steady hand at the wheel just know that Ms. Billig has been with the Office of the Chief Actuary (OCA) for more than a decade and she has a PhD in Mathematics to boot. I have zero concerns over this transition.

Easy Reading

I enjoy this report every three years because you get a glimpse into the work an actuary would do if they were looking at a trillion-dollar program covering 15 million Canadian workers and 6 million retirees (don’t forget Quebec has its own plan). It seems that the OCA has thought about every angle you can imagine. Mortality and investment return for sure – but population growth from changing birth rates and immigration as well as prospects for the economy are also mixed in. I don’t even think the Ontario Teachers’ Pension Plan would provide a budget to indulge its actuary in such a complete examination. To me, this work is money well spent on behalf of Canadians.

If you just want to jump to the answer, the Minimum Contribution Rate is now 9.75% which is less than the 9.9% that we currently contribute and slightly less than the 9.79% presented in the last report. If the MCR continues to decline, then at some point we need to ask if we are paying too much for CPP but right now let’s not get too far ahead of ourselves. I like the margin as a buffer against any of the assumptions that might not work in our favour over the next 75 years.

There is an entire section on the contribution requirements to CPP2 which came into effect January 1, 2019. Conveniently, the required contributions almost exactly line up with the rates that we are paying, which leads me to believe that when the provinces and the federal government voted to add the second tier to CPP, the chief actuary of the day had already projected the costs. In a future commentary I will spend more time on CPP2 and its cost-benefit structure with a deeper dive into the economics when the next valuation comes out in 2022. I know, you can probably hardly wait!

Money, Money, Money

The ‘fund’ has reached $372 billion – yes – billion – which is ahead of the projected $331 billion from the last report. It’s fun when you keep getting investment ‘gains’ (anyone remember the 1990s?). The question becomes whether it is reasonable to expect gains every three years? Let me save you from thinking about it – the answer is no. But if the next valuation reveals an investment loss then no one should panic if it is within a reasonable range of outcomes.

How much should we worry that investments will keep pace for decades to come? Consistent with past reports – the long-term ‘real return’ on investments is expected to be 4% per annum. Right now, Canadian Real Return bonds are yielding less than 1% so we either need the investments made by the CPP Investment Board, in particular infrastructure, to continue to pay off handsomely or we need the entire global economy to revert to a time where savers were more highly rewarded. For now, I am betting more on the former, although to fund my own retirement it would be nice to see the latter unfold in the next decade. It is just too hard to speculate about markets 25 to 50 years down the road so I won’t. I take some comfort in the fact that the way the CPP is funded we will see needed changes in contribution rates decades in advance and subject to political will-power, we will have an opportunity to make small changes over time to avoid the ‘big surprise’ that hit so many private sponsors in the 2000s.

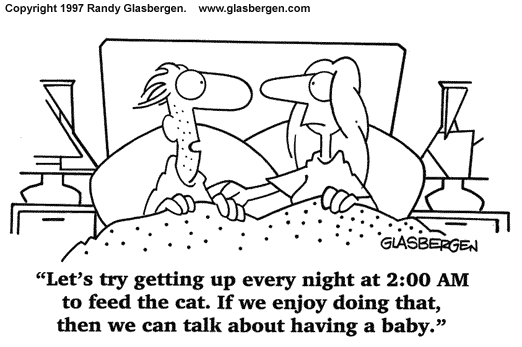

Babies, Babies, Babies

More and more, the assumption I wonder about is the fertility rate. Canada’s fertility rate in the late 1950s was 4.0 children per woman and by 2017 had fallen to 1.55. As a reminder you need a little more than 2.0 children per woman for a population to sustain itself so barring a change in heart by younger Canadians about the idea of having larger families or some major uptick in immigration, we are heading to a time when our population will start to decrease.

While the OCA has anticipated this population decline, I wonder if it will be even more pronounced than currently expected. I have three children – nothing odd there. What I noticed in the generation to follow me was the prevalence of the idea that the perfect family was 4; mom, dad and two kids. And if you could get one child of each gender (in theory a 50-50 chance) you had the ‘perfect family’. However, another generation later and more young people are only having one child and more interestingly, I am meeting more men and women that genuinely think that they will not have any kids. I know if someone age 20 says they don’t plan to have kids we should take it with a grain of salt. But I am talking to people in their 30s which likely means they have enough life experience that the decision is close to final barring some unplanned activities the next time the power goes out across half the province.

So, what happens if we see an unexpected decline in fertility? Well, Ms. Billig has considered that question. If the fertility rate drops to 1.32 then the cost of CPP rises to 10.03% which is slightly above the contribution rate of 9.9%. We should worry about any system that puts future costs on future Canadians that may never be born because that cost then must be spread unexpectedly over some other group – whether it is future tax payers or future retirees it seems a little unfair to me. With that said, a 0.1% increase in the contribution rate would be very manageable and would undoubtedly be anticipated decades ahead of anything that looked like a crisis. Now you know why I like the margin in the contribution rate that has built up in the last few valuations. I am a big fan of saving for a rainy day.

Other Stuff

There are many more assumptions that we could discuss. One is around the growth in wages and the economy. But there isn’t anything exciting enough to spend time on here, other than to note that it looks like CPP2 might benefit from lower economic growth to partially offset the increased cost of CPP1 under the same low growth scenario. I find this interesting and intuitively I can make a little sense of it, but I would have to do some hard thinking to be sure. Again, this is a project for another day since CPP2 is so new I just want to give some time before we tear it apart. Stay Tuned!