The ORPP – A Bad Idea Gets Worse

The Ontario Retirement Pension Plan – A Bad Idea Gets Worse

Here is my theory: If the picture has pretty colours it must be good news.

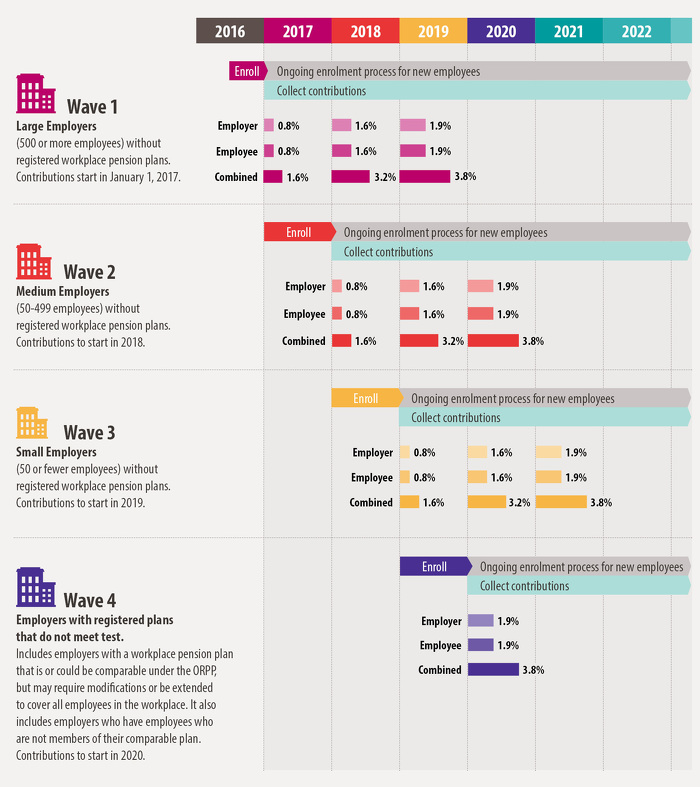

On August 11, 2015, Ontario released additional details about its brilliantly conceived solution to the perceived unpreparedness of Ontarians heading towards retirement – The ORPP. Unfortunately after you sort through the table to find out how long you can postpone starting to participate in the ORPP you realize three things: First, unless you sponsor a ‘comparable plan’ you are still joining the program in the next five years. Second, if you sponsor a plan you might be confused on whether or not it is comparable. Third, every time we get more details about the ORPP we get more complexity and a growing list of unanswered questions. I haven’t even had time to sort all the details and check all the math but I am sending out this note to give our readers a broad picture of where we stand today. Our friends at Hicks Morley wrote a detailed commentary yesterday and you can see it here or here (we have their permission).

What we just learned:

- DC Plans that have contributions of at least 8% of pay (at least 4% by employers) will be exempt in addition to the qualifying DB and MEPP plans previously designated as exempt.

- Employers that are required to participate will be phased in through 2021. Employers with more than 500 employees that don’t have a pension plan that meets the criteria for exemption will join first on January 1, 2017. Contributions will start at 0.8% for employers matched by employees and grade up over three years to 1.9% each.

- Loads of details about how you determine if a DB, DC, hybrid or combination plan is exempt. Read Hicks Morley here for an helpful explanation.

- Ontario has appointed David Dodge, Claude Lamoureux, and Gail Cook-Bennet to a Nominating Council to help select the initial Board of Directors for the ORPP Administration Corporation.

- Employers with comparable plans will have to make them mandatory without any waiting period or enroll employees in the ORPP until they join the comparable plan.

What we don’t know:

- Is the ORPP a defined benefit plan or simply a target benefit plan?

- At 3.8% of pay is it realistic to expect any indexing of benefits in retirement? What happens if the 3.8% won’t even pay for the basic monthly pension Ontario is promising?

- Will the earnings threshold be $3,500 or a higher amount?

- How many employers and workers in Ontario will now be exempt from participating?

- How much the administration and investment for the program will cost and is this a good value?

- How the payroll deductions and reporting will work (remember, the Feds are not going to collect the money for Ontario)

The DC Exemption

As I mentioned in my last post, the lobby by industry to exempt DC plans was fast and furious. I agreed with the sentiment that a good DC plan deserved exemption if a modest DB plan was being exempted. The new rules attempt to equalize the determination of ‘comparable’. I am sure the DC plan industry is thrilled to salvage the investments made over the past thirty years to build what I still consider a very viable infrastructure to provide retirement savings. But in all the celebration let’s not forget that I was arguing here that no employer should be exempted. The growing exemptions just means that this entire project will be financed by fewer contributors and dollars or worse, financed through general tax revenues which means those already in a good plan will be subsidizing those that aren’t.

Bad Math

From what I see the exemption for DB plans is based upon the accrual rate alone. That means an expensive union plan with generous early retirement benefits might not make the cut, but a weak career average plan might be ok. I need to look at this more closely but that is a discussion for another day.

Irrational Blackmail

When you blackmail someone, you generally try and get something of value which is less than the cost your victim will suffer if they don’t pay up. Somehow, this concept is lost on our current government. What we are being told is “if you don’t put in a 4%/4% plan and manage it yourself then we are going to force you to send us 1.9%/1.9% and we will do all the managing”. Ooooh. I am scared. Of course if you are like me, then you realize that 1.9%/1.9% isn’t going to buy much pension and you would rather go the exempt route even if it means improving an already existing plan or establishing a brand new plan. I think employers are wise to two things now. One, letting employees chronically under-save might backfire when the company is ready for them to retire and they are not ready. Two, Ontario has no idea how to execute the ORPP which might have sounded like a good idea before they started working through the details. I am predicting that our DC plan industry is going to be very busy setting up and modifying DC plans in the next few years.

What’s next?

We will be contacting clients directly this fall to review with them where they stand on the exemption scale. For those that are exempt then no further action is required. For those that are close to qualifying for exemption we will be having discussions about the needed changes to get over the exemption threshold. And for those that aren’t close to exemption and don’t want to move in that direction, we will continue to watch what needs to be done once enrollment in the ORPP is upon us.

For Joe Nunes, I need to decide if I want to apply to the Nominating Committee to be on the Board of the ORPP AC, wait for the Board to form and apply to be CEO, or stay on the sidelines and watch these folks like a hawk for every wasted worker and taxpayer dollar. I think I would enjoy any of these roles — it will be hard to only choose one. The only job I wouldn’t want is to be the ORPP’s chief actuary. With no clear line of sight to who will be in and who will be out each year, it will be a mighty task to show that the fixed contributions being collected can deliver the fixed benefits being promised.

Stay tuned!

Comments

3