Highlights from FSRA’s Latest Pension eBlast

Last month the Financial Services Regulatory Authority of Ontario (FSRA) issued their quarterly Pension eBlast. Here’s what you need to know from their recent eBlasts.

Pension Plans are Very Healthy

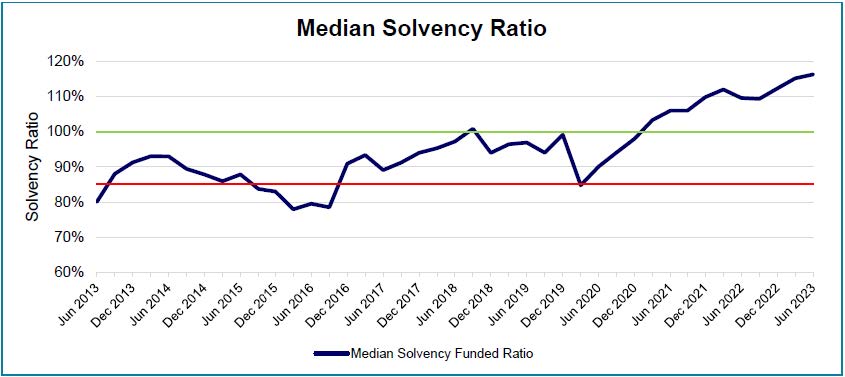

The good news keeps rolling for Ontario’s defined benefit pension plans. FSRA estimates that the median solvency ratio is at an all-time high of 116% as at June 30, 2023, plus only about 2% of plans are below 85% solvency funded.

The following graph, taken from FSRA’s latest report, shows the progression of the median solvency ratios over the past decade. How does your pension plan measure up?

Continued Decline of Single Employer DB Pension Plans

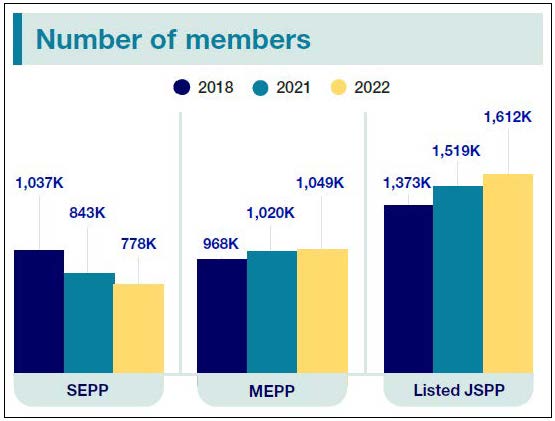

A bit of good news – bad news. The number of DB pension plans continues to trend lower, with a reduction of 68 single employer pension plans (SEPPs) and 1 multi-employer pension plan (MEPP) over the past year in Ontario. This is primarily as a result of pension plan windups and asset transfer transactions – which includes the University Pension Plan (UPP), a brand-new Jointly-Sponsored Pension Plan (JSPP). The UPP was created from the merger of six SEPPs sponsored by four Ontario universities which contributed to the overall increase in the membership and assets of JSPPs and a corresponding decrease in SEPPs.

The following graph, taken from FSRA’s latest DB Funding Report, shows that while the total number of people covered by DB pension plans in Ontario have stayed about the same over the past few years (good news!) this has been at the expense of the Single Employer Pension Plans.

Second Consultation on Guidance for Administrators

FSRA is currently conducting a second consultation on their Pension Plan Administrator Roles and Responsibilities Guidance. We’ve written about this guidance before and this new version reflects a number of clarifying updates as well as the following new sections:

- managing and retaining records

- responding to complaints and inquiries

- communicating information to plan members clearly, accurately, and timely

The new sections replace existing standalone guidance, so another nice step toward one-stop-shopping.

The consultation closes on September 28, 2023.

Administrative Monetary Penalties are Here

At the end of 2022, FSRA started imposing Administrative Monetary Penalties (AMPs) for the first time. All the AMPs imposed were related to regulatory filings that were significantly overdue and FSRA has issued plenty of warnings and given second, third, etc. chances, so no one should be surprised.

It’s interesting to note that most of the late filings were related to DC pension plans. It appears that many DC plan sponsors don’t realize that they need to comply with mandatory annual filings with FSRA. Perhaps they incorrectly think that they have a Group RRSP/DPSP program? More likely it’s due to employee turnover at smaller companies and FSRA’s reminder emails go to the inbox of the former employee. Some employers clearly need to do a better job in keeping their contact information current with FSRA and could probably use the help of a good advisor.

Helpfully, FSRA has put together a two-pager on DC Pension Plans – What Employers Need to Know.

FSRA Audits are Returning

Apparently, FSRA has revamped its plan examination framework and has been piloting the new approach throughout 2023 with a small number of pension plans.

The pilot of the new plan examination framework aims to evaluate the effectiveness of FSRA’s risk-based process for selecting plans, its ability to identify governance and compliance issues, and ultimately deliver a report back to the pension administrator that will be insightful, actionable, and consider the unique aspects of each plan type examined. Let’s hope that these audits are appropriately tailored to the size and complexity of the company’s pension plan.

I expect that FSRA will significantly ramp up its full audit process in 2024 – will your pension plan be one of the ‘lucky’ ones? By the way, if you’re selected for an audit, keep calm and carry on.

Comments