Insurance Comedy

Some people think that actuaries lack a sense of humour. This is not true, actuaries are funny – the catch is that some of the humour is wrapped in obscure references to mathematics, mortality, and insurance principles.

At the end of October, I spent more than two hours trying to purchase home insurance. Parts of the story are unbelievable. Of course, the parts of the story about call centre hell are believable. Nonetheless, knowing that many of our readers work in the insurance industry and we all end up dealing with a call centre sooner or later, I am going to tell my story. I am going to change the names of the people since I am not trying to embarrass real people but just tell you what to me seems like a script for a three-act comedy at the Stratford Festival.

The House

At the end of the summer I convinced Paula to move houses. The new house has a bigger backyard and a main floor primary bedroom. These were things important to us for the next stage of life as soon to be empty nesters (or maybe not that soon, we will see) and our plan is to stay in a house for as long as possible which is something our government is going to be pushing as our long-term care system bursts at the seams. Like my dad wished for and realized with my childhood home, I hope they carry me out of this next house in a box.

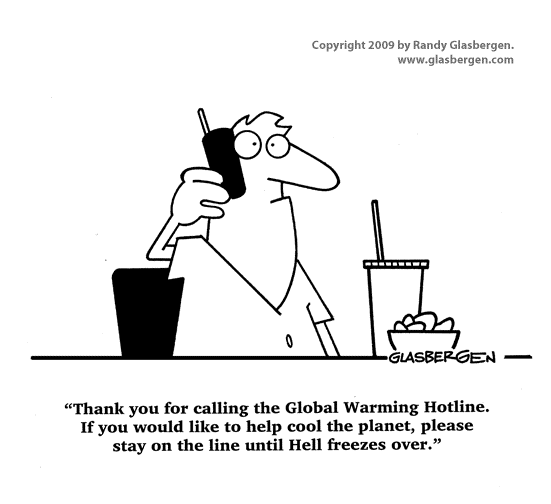

The Call Centre

So next step, get house insurance before we move in. Seems simple, call your home insurer and tell them that you are moving and ask for coverage on the new house. How hard can this be? Well it turns out since the last time I called they have updated the system to protect my data. This is a three-step process. Step 1, what is my birthday? Check! Step 2, they will text or call me with a 6-digit PIN, that I can then read back to them. Let the fun begin:

So, if you are on the phone dealing with a computer it makes sense for them to text you – otherwise how do you take the call. I chose text. Check! OK, they have two phone numbers for me, which one do I want them to use? Tell them the last 4-digits of your phone number – I do that – nope, that isn’t one of the options. Do you want me to tell you the list of phone numbers we have? Yes, Check! This is where I find out that the phone numbers that they have are my home landline and my work landline. OK, so text won’t work. Next question, which number should we text? Wait, I want to change to call……that isn’t an option at this point, I must pick a number. I give up and hang up to call back so I can get it right the next time.

Call #2. Birthdate? Check! Call or text? Call! OK, we will text you, which number……crap!

Call #3. Birthdate? Check! Call or text? {pause} CALL. OK, we will call you, what are the last four digits of your number? 9341 (home phone number). Run downstairs from home office and answer home phone, write down the 6-digit PIN while I am using headset from home office phone and read back the 6-digit PIN. Check! I am sorry I don’t recognize that number, please try again. Crap! Read PIN more slowly. I am sorry I don’t recognize that number. {In my head…are you f%$king kidding me, you just gave me that number on the other line – I want to cry} {pause to think} Computer: OK, let’s proceed with the call anyway.

WTAF? I didn’t need the last 15 minutes of runaround to get you a PIN??

Underwriting

Short wait on hold, and hello Brian. Brian is friendly and although he has a slight accent his English is perfect. I don’t bother to mention the runaround with the PIN but I do ask to add my cell phone to the account (so that they can text me the PIN the next time).

I wish underwriting home insurance were quick – but there are lots of questions to answer. It would be great if you gave them the address and they could say that they have downloaded the publicly available data from MPAC and they know what they are insuring. Unfortunately, not so much – there are questions about out-buildings and expensive art. No and no, Check and Check! There are also questions about the identity theft rider and the umbrella policy for the cars. Check! I want a higher than standard deductible. Check! All of this takes some time, but I get this part.

I also mention that for some reason they have our correct mailing address for the current house but there is a typo on the ‘property insured’ section that I suggest they fix. Hold please. OK, so I am going to have to transfer you to our VIP department because the address change means that you are in a nicer home than we thought you were, and you are now a VIP {trumpets sound}.

Hold…transfer…Lynn takes it from here. She is not a VIP broker and the best I can figure out is that she is an assistant to the pool of VIP brokers and once we get the policy in place she can do all the customer service….interesting model but given all the data collection it makes sense maybe to have someone build the case file to hand off to the expert – maybe. Lynn is a friendly voice but doesn’t seem to have a job at this point other than to chat with me so that I don’t have to listen to music on hold.

VIP Status

Another bunch of time and I get to Frank. Frank wants to assure me that he is here to help. Frank tells me that he is in a COMPLETELY DIFFERENT DEPARTMENT than Brian with an air of confidence that I am now dealing with the caliber of broker that can handle an important and complex client that I of course must be. Frank tells me that I will never have to go through the call centre again and instead will have a direct line to him. Sounds amazing really.

Frank wants a minute to have a quick look at my file. Unfortunately, you can tell by the hesitation in his voice it isn’t good news. In a nutshell, the correct address for my current home means two things. First, they want to make me a VIP – second, they want to tell me that my current premiums are going way up because this house would cost 50% more to rebuild than they budgeted.

I do the math in my head and I say to Frank that its only 35 days of coverage for the current house so let’s just get it over with and move on to get insurance for the new house. Can’t – Frank will need to talk to HIS manager. This experience with Frank isn’t feeling so VIP anymore. OK, fine, go talk to your manager, let’s just bind the coverage for the new house so I can cross that off the to-do list. Can’t! Why not? Wait for it!!

Well you see, the reason that you were bumped to VIP was because when we updated the address on your current home you crossed the threshold to VIP status. But the new home that you are buying is below the VIP status so my manager might say that we need to send you back to the other department to finalize the quote that they prepared…ugh.

Frank says he will call me back within a few days once he talks to his manager. I don’t know whether to laugh or cry. When he calls me back, I am going to ask him his date of birth and his 6-digit PIN.

VIP No More

I received a voicemail asking me to call back on the 1-800 line. Frank was right, I am no longer important enough for his VIP department. I called the 1-800 number back and this time I get to talk to Laura. Although Laura could see the answers that I had previously provided, she insisted on re-reading each question, telling me my prior answer, and asking me if my answer had changed. It has been 4 days. So, basically a redo. Once that effort was complete, she was having a ‘system problem’ and asked me to hold. I think the problem is the computer doesn’t like some combination of answers and she again needs to get a supervisor to approve the coverage. I am not sure what is so complicated or risky about the new house – but one wonders.

Done! New insurance organized for approval by underwriting! 45 minutes for the call…after two hours the week before. I am successfully conditioned to think the last call was quick. I guess large companies have no choice but to put in place computer systems and rules to make things efficient for them. Unfortunately, their efficiency comes at the expense of my time and sanity. To add to the pain, they suggested I might want to call back in a week to make sure the underwriting department approved the policy. We didn’t get the policy in the mail so I called 10 days later and the policy ‘has just been approved by underwriting’ so they can finalize the policy now. There’s another 22 minutes…you have to wonder if I didn’t call if the transaction would have been completed.

I have dealt with the same insurer since I graduated University. I have written before about the value of a good broker yet because the insurer is part of an alumni program and I just fell into the relationship 29 years ago and also because I have a good understanding of insurance, there is no broker between us. Maybe it is time to find out if there is a better deal out there or at least a better semi-VIP service. Maybe I will end up staying with my current insurer, but poor service has opened the door to change.

Comments