Executive Compensation

In March, Canada’s banks announced earnings and compensation for their executives. I want to call out a compensation practice that I find disappointing. I am not going to name the specific CEO or bank because I am not trying to shame them specifically. If I am successful with this rant, I will shame them all.

Let’s be Fair

When my siblings and I were kids and complained that ‘life isn’t fair’ we were reminded that it isn’t meant to be fair and there was no point in complaining having already won the global lottery by being born in Canada to parents that had a warm house and a stable income – no air conditioning though.

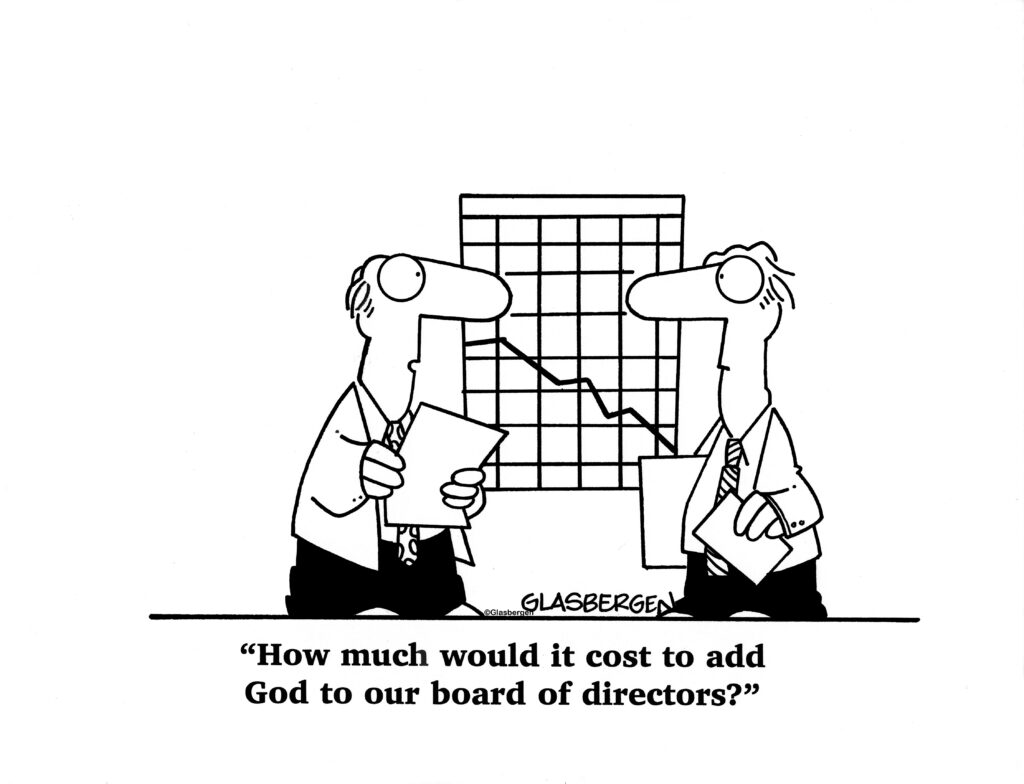

So why is it that intelligent adults that serve as CEOs in Canada feel comfortable pointing at the executives in luxurious offices next door saying that they should get what someone else has – sometimes more? And why is it that other intelligent adults serving as directors on company boards give a pass to this habit of giving more and more because directors in the boardroom next door are giving more and more?

This little gem from a press release is what set me off.

“[The Bank], like other banks, does not consider pension compensation part of “direct” pay. The pension amount [The Bank] and other companies report in the disclosure required by regulators isn’t cash placed in an account, but an estimate of how much executives’ pensions have grown – or, in rare cases, shrunk – based on their earnings in the past year.”

I don’t know how you define “direct” pay. But to tell me that we should ignore the details of these pension promises is more than a little offensive. I checked the circular for the bank – and the CEO was given a modest pension of $125,000 in 2020. To be clear, this isn’t a promise to pay the CEO a pension of $125,000 a year when they retire – it is the addition to the pension in retirement for the one year worked – 2020! You can make the assumptions you want about the future but that’s around $2 million in present value. I guess that’s chump change for the shareholders to fork over. Even our most recent Governor General had to work about 4 years to get such a generous pension.

Dignity in Retirement

We all know that it is hard to save for retirement – ironically, Canadian banks tell us this all the time – especially in February around the RRSP deadline. So, of course I feel sorry for someone making $10 million a year not being able to make ends meet and needing the company to make sure they can afford to retire at a reasonable age with a reasonable income. We all know that the only way to do this is a defined benefit plan which clearly the top execs enjoy.

It would be great if the executives leading the bank would walk the walk and provide a defined benefit pension plan to its employees too. I am sure once upon a time they did but everything I can find online says the regular folks are in a defined contribution plan now. You see, what most well-informed executives will tell you is that there is just too much risk in running a defined benefit plan and they have a duty to shareholders to limit that risk – except for their own pensions of course.

Interestingly, this CEO’s pension earned to date is valued at about $22 million which is about 10% more than the $20 million the bank paid in 2016 to 1,600 employees to settle the class action claim for unpaid overtime. I can only imagine the hours and legal fees spent fighting employees for a few dollars so that the board could with the stroke of the pen spend it on one individual deemed ‘irreplaceable’.

Pay for Performance

I forget when the rules on disclosure changed, but somewhere in the last 30 years regulators thought it was important for publicly traded companies to disclose how much they were paying their ‘top 5’ executives. As it turns out this was the fuel that all executives needed to point to how much someone else was making to do the same job with the same results.

I am a big fan of ‘pay for performance’. When I decided to go on my own, I felt good about the fact that my earnings would be directly tied to the value that I created for clients. I will admit I was taken a little by surprise on how hard it is to create value when you work alone, have no brand name and have little industry reputation to assure clients that they should ask you for help.

Over the years our team has grown and so has our reputation and I think everyone at ASI is paid reasonably well for the role they play. But I also realize that there is subjectivity in every compensation decision since it is impossible to divide the entire contribution of the team into individual buckets for each worker. What we do know though is that when things go well, everyone is part of that result and when it’s a tough year, then everyone shares the responsibility. Of course it is fair to ask the more senior team members to take greater ‘risk’ in their pay which means more volatility in total pay between good years and bad years.

You can slice and dice the data how you like and rationalize your decisions however you want. However, when a bank tells me that profits are down 26% so we have cut the CEOs pay by 7% it makes you wonder how much pay is really tied to performance and how much pay that is said to be at risk really isn’t because directors will find an excuse to pay it to the executives nonetheless.

To me the best and only good answer on executive pay is for executives to be shareholders. I am not happy with stock options that pay off if shares go up in price but don’t take something away from executives when shares go down in price. The easy answer is we will give you your base salary in cash and we will give you your ‘bonus’ in shares – the shares vest 10% a year starting at retirement. This will give you income in retirement and an incentive to make sure that you develop successors to lead the way for a decade after you are gone.

When Ken Hugessen left Mercer to start his own firm, he told all of us that he thought that directors needed independent advice on executive compensation to make sure that you didn’t have the fox guarding the hen house. This bank paid Ken’s firm $281,663 in 2020 so I am not sure how easy it would be to stand up and give the directors advice that they don’t want. Directors, if they look hard enough would just find someone else to give them the advice they want to hear. The answer to me is like the auditor, the compensation consultant should be appointed by the shareholders and not chosen by the directors that one worries are a little too cozy with the CEOs they see on weekends at their private club.

Many of us own shares in Canada’s publicly traded companies, either directly or as part of our retirement savings plans. As shareholders we are paying for the CEO’s pension, as taxpayers we are paying for the Governor General’s pension. It is a little tough to take sometimes.

Comments